Colorado’s 2018 ballot includes a number of statewide offices and ballot measures that intend to address the state’s population and economic growth, education funding, and the balance of local land/safety with oil and gas interests.

Colorado’s statewide offices are largely controlled by Republicans, which could change significantly with a number of strong Democratic challengers. The state legislature currently is split (rare among the 50 US states) between a slight Democratic majority in the House and a slight Republican majority in the Senate.

While much of the election’s focus has been on national politics, 2018’s results will largely determine Colorado’s direction for the next four to eight years and adds more reason to make ensure you (and your friends!) vote.

Federal Offices

I’ve written about Joe Neguse: “Joe is incredibly bright, engaging, and will fight to protect the environment in Colorado. As a son of Eritrean immigrants, I could not be prouder to have Joe represent me at a time when immigrants should be valued, celebrated.” As Joe said at a recent campaign event, “I’m running for congress because that dream—the American dream—is under attack like it has never been in my lifetime.” I completely agree.

While some have attacked Joe as not being progressive enough for various reasons, I’ve seen in Joe’s work and experience that he will work hard to represent progressive values we have in Boulder and Colorado.

State Offices

Governor/Lieutenant Governor — Jared Polis / Dianne Primavera – Democratic

Secretary of State — Jena Griswold – Democratic

State Treasurer — Dave Young – Democratic

Attorney General — Phil Weiser – Democratic

State Board of Education Member – Congressional District 2 — Angelika Schroeder – Democratic

Regent of the University of Colorado – At Large — Lesley Smith – Democratic

State Representative – District 13 — K.C. Becker – Democratic

I’m voting for Democrats all the way down the ballot. I’ll give a few key points about some of the candidates and what’s at stake. I’m voting for Jared Polis for governor because he’s going to push our state in a progressive direction on clean energy and I hope to ensure our state grows in an equitable way with opportunity for all people. I think Jared’s business background is a positive overall, but would like him to have supported more progressive ballot measures this year (prop 73 for increasing education funding and prop 112 for safer setbacks from fracking). It’s clear that progressives in Colorado will need to keep pushing our elected leaders when they take moderate or conservative positions as many have this election cycle.

For other statewide offices, I’m voting Jena Griswold for secretary of state as we need to continue to push to remove barriers to participation for voters in Colorado, including a push for automatic voter registration. I’m supporting Phil Weiser for attorney general as someone who will push back on the overreach from the Trump administration. I’m supporting Lesley Smith for CU Regent because the board’s current conservative majority has been pushing its regressive ideology onto CU system, and as someone who considers Lesley a friend personally, I could not think of a person with better experience and progressive values to bring a thoughtful, practical direction to the university board.

Local Offices

District Attorney – 20th Judicial District — Michael Dougherty – Democratic

Regional Transportation District Director – District O — Lynn Guissinger

County Offices County Commissioner – District 3 — Matt Jones – Democratic

County Clerk and Recorder — Molly Fitzpatrick – Democratic

County Treasurer — Paul Weissmann – Democratic

County Assessor — Cynthia Braddock – Democratic

County Sheriff — Joseph K Pelle – Democratic

County Surveyor — Lee Stadele – Democratic

County Coroner — Emma R. Hall – Democratic

Most Boulder county/local offices for the 2018 election cycle have candidates who are unopposed. Largely the candidates won contested Democratic primaries and have no general election opponents, so I won’t go into depth on those races.

The county commissioner race offers several candidates (and had multiple Democratic candidates in the caucus/convention process, but not one candidate strong enough to force a primary). While I considered Cliff Willmeng, his most relevant experience in is limited to anti-fracking efforts, and I don’t believe he’ll be an effective county commissioner which is not only a political but managerial position.

I will vote for Matt Jones, largely due to his experience in the legislature and management, but I do not believe his platform offers any strong vision or track record to address Boulder County’s real transportation and affordable housing challenges. He offers no plan to reduce the cost of housing or pursue different housing options. Rather than focus on making transportation work for our region, his issues/positions page attacks the scapegoats of regional rail funding and public-private partnerships. My hope is that Matt listens to strategies to allow Boulder County to meet its infrastructure needs by making additional investments in transit and enabling cities to provide housing for our growing economy and population.

Judicial Retention

I’m voting to retain all of the judges on the ballot. Here’s a good tweet thread from Erin Overturf on reading more about judges where she mentions the Colorado Judicial Performance Evaluations web site:

You can read in the Denver Post for more information: How to handle questions about judges on your Colorado ballot

State Ballot Measures

Colorado Amendment W, Judge Retention Ballot Language Amendment — YES

Colorado Amendment V, Reduced Age Qualification for General Assembly Members Amendment — YES

Colorado Amendment X, Definition of Industrial Hemp Amendment — YES

Colorado Amendment Y, Independent Commission for Congressional Redistricting Amendment — YES

Colorado Amendment Z, Independent Commission for State Legislative Redistricting Amendment — YES

Colorado Amendment A, Removal of Exception to Slavery Prohibition for Criminals Amendment — YES

Colorado Amendment 73, Establish Income Tax Brackets and Raise Taxes for Education Initiative — YES

Colorado Amendment 74, Compensation to Owners for Decreased Property Value Due to State Regulation Initiative — NO

Colorado Amendment 75, Campaign Contribution Limits Initiative — NO

Colorado Proposition 109, “Fix Our Damn Roads” Transportation Bond Initiative — NO

Colorado Proposition 110, “Let’s Go Colorado” Transportation Bond and Sales Tax Increase Initiative — YES

Colorado Proposition 111, Limits on Payday Loan Charges Initiative — YES

Colorado Proposition 112, Minimum Distance Requirements for New Oil, Gas, and Fracking Projects Initiative — YES

Boulder County/City Ballot Measures

County Ballot Issue 1A – (Alternative Sentencing Facility and Jail Modernization Countywide Sales and Use Tax Extension) — YES

City of Boulder Ballot Issue 2C – Imposition of Oil and Gas Pollution Tax — YES

City of Boulder Ballot Issue 2D – Authorize Retention of All Sugar-Sweetened Beverages Tax — YES

City of Boulder Ballot Question 2E – Charter Amendments for Initiative, Referendum and Recall Processes — NO

City of Boulder Ballot Question 2F – Charter Amendment for Initiative Petition Signature Verification — YES

City of Boulder Ballot Question 2G – Charter Amendment Related to Electronic and Online Petitions — YES

City of Boulder Ballot Question 2H – Charter Amendment Related to Advisory Commissions — NO

City of Boulder Ballot Question 2I – Charter Amendment for Planning Department Budget Recommendations — YES

Urban Drainage and Flood Control District Ballot Issue 7G — YES

State Ballot Measures (Analysis)

Colorado Amendment V, Reduced Age Qualification for General Assembly Members Amendment — YES

Colorado state legislative text

Ballotpedia link

Shall there be an amendment to the Colorado constitution concerning a reduction in the age qualification for a member of the general assembly from twenty-five years to twenty-one years?

I’m voting yes — the change would put Colorado in line with many other states in reducing the required age to 21 or lower.

Colorado Amendment W, Judge Retention Ballot Language Amendment — YES

Colorado state legislative text

Ballotpedia link

Shall there be an amendment to the Colorado constitution concerning a change in the format of the election ballot for judicial retention elections?

I’m voting yes — the change would simplify the judges section of the ballot, while still maintaining clarity about which judges are at the state and local levels.

Colorado Amendment X, Definition of Industrial Hemp Amendment — YES

Colorado state legislative text

Ballotpedia link

Shall there be an amendment to the Colorado constitution concerning changing the industrial hemp definition from a constitutional definition to a statutory definition?

I’m voting yes — I think the proposal from Colorado Senator Fenberg is forward-looking, even with some uncertainty due to federal policy. The current hemp definition is very similar to the federal definition, causing no change in the current term.

From Ballotpedia:

The Colorado Constitution defines industrial hemp as “the plant of the genus cannabis and any part of such plant, whether growing or not, with a delta-9 tetrahydrocannabinol (THC) concentration that does not exceed three-tenths percent on a dry weight basis.” Federal law defines industrial hemp as “the plant Cannabis sativa L. and any part of such plant, whether growing or not, with a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis.”[4][5]

However, in June, the US Senate signaled easing in policy regarding marijuana/hemp, “U.S. Senate Votes To Legalize Hemp After Decades-Long Ban Under Marijuana Prohibition.” Given the current political environment and “six-in-ten Americans support marijuana legalization,” I think the positive-risk of adopting the amendment outweighs any downside risk of a federal tightening on hemp policy.

Additional reading:

Sudden opposition flares toward Amendment X, the hemp measure unanimously approved by the Colorado legislature — Colorado Sun

Colorado Amendment Y, Independent Commission for Congressional Redistricting Amendment — YES

Colorado Amendment Z, Independent Commission for State Legislative Redistricting Amendment — YES

Colorado state legislative text (Amendment Y, Amendment Z)

Ballotpedia link (Amendment Y, Amendment Z)

Shall there be an amendment to the Colorado constitution concerning a change to the way that congressional districts are drawn, and, in connection therewith, taking the duty to draw congressional districts away from the state legislature and giving it to an independent commission, composed of twelve citizens who possess specified qualifications; prohibiting any one political party’s control of the commission by requiring that one-third of commissioners will not be affiliated with any political party, one-third of the commissioners will be affiliated with the state’s largest political party, and one-third of the commissioners will be affiliated with the state’s second largest political party; prohibiting certain persons, including professional lobbyists, federal campaign committee employees, and federal, state, and local elected officials, from serving on the commission; limiting judicial review of a map to a determination by the supreme court of whether the commission or its nonpartisan staff committed an abuse of discretion; requiring the commission to draw districts with a focus on communities of interest and political subdivisions, such as cities and counties, and then to maximize the number of competitive congressional seats to the extent possible; and prohibiting maps from being drawn to dilute the electoral influence of any racial or ethnic group or to protect any incumbent, any political candidate, or any political party?

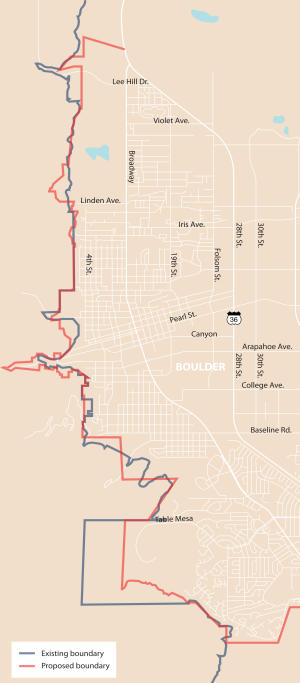

I’m voting yes — the change should remove partisanship and racial bias from redistricting efforts, which has led to a number of high profile racial and political gerrymandering cases in recent years. You can read a more in-depth piece on the problems with gerrymandering by David Wasserman: The Gerrymandering Project—Hating Gerrymandering Is Easy. Fixing It Is Harder. I think the proposed change should move Colorado forward to a more fair electoral system.

Some critiques worth mentioning: the change would also somewhat “lock in” the current two-party system power structure, which could have negative partisan effects on third parties. Also, while the system would outline a way to make partisan members of the commission balanced, no consideration is given to ensure racial diversity in commission selection.

Additional reading:

Amendments Y and Z aim to take politics out of redistricting: Here’s how they’d work — Colorado Independent

Steve Fenberg and Peggy Leach: Amendments Y, Z put the interests of Colorado, not parties, first — Daily Camera

Colorado Amendment A, Removal of Exception to Slavery Prohibition for Criminals Amendment — YES

Colorado state legislative text

Ballotpedia link

Shall there be an amendment to the Colorado constitution that prohibits slavery and involuntary servitude as punishment for a crime and thereby prohibits slavery and involuntary servitude in all circumstances?

I’m voting yes — for the same reasons I voted for Amendment T in 2016 (which failed narrowly) — ”Colorado needs to go even further to eliminate prison labor entirely.”

Additional reading:

Colorado voters will get a second chance next month to abolish slavery — CNN

Colorado Amendment 73, Establish Income Tax Brackets and Raise Taxes for Education Initiative — YES

Colorado state legislative text

Ballotpedia link

SHALL STATE TAXES BE INCREASED $1,600,000,000 ANNUALLY BY AN AMENDMENT TO THE COLORADO CONSTITUTION AND A CHANGE TO THE COLORADO REVISED STATUTES CONCERNING FUNDING RELATING TO PRESCHOOL THROUGH HIGH SCHOOL PUBLIC EDUCATION, AND, IN CONNECTION THEREWITH, CREATING AN EXCEPTION TO THE SINGLE RATE STATE INCOME TAX FOR REVENUE THAT IS DEDICATED TO THE FUNDING OF PUBLIC SCHOOLS; INCREASING INCOME TAX RATES INCREMENTALLY FOR INDIVIDUALS, TRUSTS, AND ESTATES USING FOUR TAX BRACKETS STARTING AT .37% FOR INCOME ABOVE $150,000 AND INCREASING TO 3.62% FOR INCOME ABOVE $500,000; INCREASING THE CORPORATE INCOME TAX RATE BY 1.37%; FOR PURPOSES OF SCHOOL DISTRICT PROPERTY TAXES, REDUCING THE CURRENT RESIDENTIAL ASSESSMENT RATE OF 7.2% TO 7.0% AND THE CURRENT NONRESIDENTIAL ASSESSMENT RATE OF 29%TO 24%; REQUIRING THE REVENUE FROM THE INCOME TAX INCREASES TO BE DEPOSITED IN A DEDICATED PUBLIC EDUCATION FUND AND ALLOWING THE REVENUE COLLECTED TO BE RETAINED AND SPENT AS VOTER-APPROVED REVENUE CHANGES; REQUIRING THE LEGISLATURE TO ANNUALLY APPROPRIATE MONEY FROM THE FUND TO SCHOOL DISTRICTS TO SUPPORT EARLY CHILDHOOD THROUGH HIGH SCHOOL PUBLIC EDUCATIONAL PROGRAMS ON AN EQUITABLE BASIS THROUGHOUT THE STATE WITHOUT DECREASING GENERAL FUND APPROPRIATIONS; DIRECTING THE LEGISLATURE TO ENACT, REGULARLY REVIEW, AND REVISE WHEN NECESSARY, A NEW PUBLIC SCHOOL FINANCE LAW THAT MEETS SPECIFIED CRITERIA; UNTIL THE LEGISLATURE HAS ENACTED A NEW PUBLIC SCHOOL FINANCE LAW, REQUIRING THE MONEY IN THE FUND TO BE ANNUALLY APPROPRIATED FOR SPECIFIED EDUCATION PROGRAMS AND PURPOSES; REQUIRING THE MONEY IN THE FUND TO BE USED TO SUPPORT ONLY PUBLIC SCHOOLS; REQUIRING GENERAL FUND APPROPRIATIONS FOR PUBLIC EDUCATION TO INCREASE BY INFLATION, UP TO 5%, ANNUALLY; AND REQUIRING THE DEPARTMENT OF EDUCATION TO COMMISSION A STUDY OF THE USE OF THE MONEY IN THE FUND WITHIN FIVE YEARS?

I’m voting yes — Colorado education funding has consistently been near last in the nation, even during a boom time for the state (“Despite a booming economy, Colorado’s school funding lags well below national average”). Previous statewide education funding measures have failed, and with the state’s budget highly constrained by TABOR, directly asking voters for money is largely the only solution.

I support the measure for three reasons: 1. the state’s schools desperately need more funding and to decrease the “More than half of Colorado school districts adopt 4-day weeks to cut costs.” 2. Requiring the state legislature to fund equitable early childhood education 3. Establish a progress, dedicated funding mechanism for these goals to ensure that Colorado’s growth and well-off populations contribute to our education system.

I’m disappointed so many Democratic leaders have not supported the measure as the proposal lives up to democratic values we should uphold in Colorado.

Additional reading:

Amendment 73: Understanding the tax increase for education on your Colorado ballot — Chalkbeat

Colorado Amendment 74, Compensation to Owners for Decreased Property Value Due to State Regulation Initiative — NO

Shall there be an amendment to the Colorado constitution requiring the government to award just compensation to owners of private property when a government law or regulation reduces the fair market value of the property?

I’m voting no — as should every person in Colorado. The toxic amendment pushed by the oil and gas industry. Not a single newspaper in the state has endorsed the measure, with members of all political parties talking about the problems with the constitutional change. Even the Colorado Spring Gazette’s conservative-leaning editorial board stated: “The Gazette’s editorial board erred on the side of property rights but erred nonetheless with our initial support for Amendment 74. Voters could easily make a similar mistake, so we urge readers to consider the full ramifications of this ballot measure.”

Additional reading:

Editorial: Amendment 74’s potential for damage is enormous

Guest Post: Amendment 74 – A Pandora’s box of property rights

EDITORIAL: We were wrong on Colorado Amendment 74

Colorado Amendment 75, Campaign Contribution Limits Initiative — NO

Colorado state legislative text

Ballotpedia link

Shall there be an amendment to the Colorado constitution providing that if any candidate in a primary or general election for state office directs more than one million dollars in support of his or her own election, then every candidate for that office in the same election may accept five times the amount of campaign contributions normally allowed?

I’m voting no — while seeming well-intentioned (which is a stretch considering the secretive funding behind this ballot measure), I believe the measure would lead to aggregate increases in spending on elections. In addition to millionaires, the constitutional amendment also states:

(c) A candidate facilitating or coordinating third party contributions amounting to more than one million dollars to any committee or organization for the purpose of influencing the candidate’s own election

Given various political action committees involved in campaigns that could top $1 million, I’m not convinced that the measure would have the effect of decreasing overall spending, but rather would increase limits of what individuals could spend. Rather than leveling the playing field, the amendment’s design would be a mechanism to funnel further money into politics.

Colorado Proposition 109, “Fix Our Damn Roads” Transportation Bond Initiative — NO

Colorado state legislative text

Ballotpedia link

SHALL STATE DEBT BE INCREASED $3,500,000,000, WITH A MAXIMUM REPAYMENT COST OF $5,200,000,000, WITHOUT RAISING TAXES OR FEES, BY A CHANGE TO THE COLORADO REVISED STATUTES REQUIRING THE ISSUANCE OF TRANSPORTATION REVENUE ANTICIPATION NOTES, AND, IN CONNECTION THEREWITH, NOTE PROCEEDS SHALL BE RETAINED AS A VOTER-APPROVED REVENUE CHANGE AND USED EXCLUSIVELY TO FUND SPECIFIED ROAD AND BRIDGE EXPANSION, CONSTRUCTION, MAINTENANCE, AND REPAIR PROJECTS THROUGHOUT THE STATE?

I’m voting no — not only is proposition 109 poor governance by increasing debt without a funding mechanism, the use of funding would be exclusive to building new roads and highways without any change or flexibility to current policy.

Increasing debt without paying for that debt means that at some later point, revenues must be raised or shifted from the existing budget (already constrained) to pay for these liabilities.

On transportation needs, as Colorado grows to become more urban, we need to fund transportation policy that provides an array of options for not only roads, but transit, biking, walking, with additional focus on city/regional infrastructure. The measure would not change the paradigm of transportation needed, but rather direct funds that don’t address Colorado’s long-term transportation problems.

Colorado Proposition 110, “Let’s Go Colorado” Transportation Bond and Sales Tax Increase Initiative — YES

Colorado state legislative text

Ballotpedia link

SHALL STATE TAXES BE INCREASED $766,700,000 ANNUALLY FOR A TWENTY-YEAR PERIOD, AND STATE DEBT SHALL BE INCREASED $6,000,000,000 WITH A MAXIMUM REPAYMENT COST OF $9,400,000,000, TO PAY FOR STATE AND LOCAL TRANSPORTATION PROJECTS, AND, IN CONNECTION THEREWITH, CHANGING THE COLORADO REVISED STATUTES TO: 1) INCREASE THE STATE SALES AND USE TAX RATE BY 0.62% BEGINNING JANUARY 1, 2019; REQUIRING 45% OF THE NEW REVENUE TO FUND STATE TRANSPORTATION SAFETY, MAINTENANCE, AND CONGESTION RELATED PROJECTS, 40% TO FUND MUNICIPAL AND COUNTY TRANSPORTATION PROJECTS, AND 15% TO FUND MULTIMODAL TRANSPORTATION PROJECTS, INCLUDING BIKE, PEDESTRIAN, AND TRANSIT INFRASTRUCTURE; 2) AUTHORIZE THE ISSUANCE OF ADDITIONAL TRANSPORTATION REVENUE ANTICIPATION NOTES TO FUND PRIORITY STATE TRANSPORTATION MAINTENANCE AND CONSTRUCTION PROJECTS, INCLUDING MULTIMODAL CAPITAL PROJECTS; AND 3) PROVIDE THAT ALL REVENUE RESULTING FROM THE TAX RATE INCREASE AND PROCEEDS FROM ISSUANCE OF REVENUE ANTICIPATION NOTES ARE VOTER-APPROVED REVENUE CHANGES EXEMPT FROM ANY STATE OR LOCAL REVENUE, SPENDING, OR OTHER LIMITATIONS IN LAW?

I’m voting yes — proposition 110 has both a funding mechanism and an array of transportation uses that provide needed state funding and local government flexibility. The Let’s Go Colorado web site has a helpful list of projects that may be prioritized or funded if prop 110 passes. You can see bus rapid transit and multi-modal/bikeways are options in the Boulder and county area.

My critiques of the measure: the main disappointment I have is the funding mechanism, which is a largely regressive sales tax. I would have preferred a significant component as a user fee (i.e. increasing the gas tax) which would be more equitable and have a lesser impact on working class people. While other states have successfully increased the gas tax, polling in Colorado has dissuaded many from even trying for an increase.

Additional reading:

Editorial: Fix our roads with Proposition 110, not Proposition 109 — Daily Camera

Coloradoan editorial board endorsement: On transportation, yes to 110, not so fast on 109 — Coloradoan

Vote ‘no’ on Prop. 109 and ‘yes’ on Prop. 110 to fund transportation in Colorado — Vail Daily letter

Sue Prant: Proposition 110 will make biking better — Daily Camera

Guest Post: Why Proposition 110 is the only real option for Colorado — Colorado Independent

Proposition 110 Projects Map — CDOT

Colorado Proposition 111, Limits on Payday Loan Charges Initiative — YES

Colorado state legislative text

Ballotpedia link

Shall there be an amendment to the Colorado Revised Statutes concerning limitations on payday lenders, and, in connection therewith, reducing allowable charges on payday loans to an annual percentage rate of no more than thirty-six percent?

I’m voting yes — payday loans are predatory services extended to people who have few options for a loan. While the measure would still allow high interest loans, prop 111 is a reasonable reduce exploitation of people in need of short-term cash. While some have argued that the law would “crush” payday loan providers, based on other states enacting similar laws still have a significant number of payday lenders operating in their states. The tradeoff is a positive for Colorado and we should gladly take it.

Additional reading:

Proposition 111 in the 2018 Colorado election: What to know about limitations on payday loans — Denverite

Colorado Proposition 112, Minimum Distance Requirements for New Oil, Gas, and Fracking Projects Initiative — YES

Colorado state legislative text

Ballotpedia link

Shall there be a change to the Colorado Revised Statutes concerning a statewide minimum distance requirement for new oil and gas development, and, in connection therewith, changing existing distance requirements to require that any new oil and gas development be located at least 2,500 feet from any structure intended for human occupancy and any other area designated by the measure, the state, or a local government and authorizing the state or a local government to increase the minimum distance requirement?

I’m voting yes — prop 112 is perhaps the most controversial measure on the 2018 ballot. Per the Denver Post:

The initiative aims to increase the required distance of any newly drilled wells from homes, schools and water sources to 2,500 feet. The current setback is 500 feet from homes and 1,000 feet from densely occupied buildings, like hospitals and schools.

The most pressing questions: 1. Will the setbacks increase safety? 2. Will the change drastically affect the Colorado economy? 3. Who’s supporting the measure and how?

The Denver Post’s article “Proposition 112: Dissecting the science behind the oil and gas setbacks initiative” tries to gather evidence for increased regulation of oil and gas drilling. While larger studies have found limited health impacts, we’ve seen very limited regulation of oil and gas operations’ effects on air quality and groundwater. The initiative would provide a buffer from immediate effects of fracking as well as reducing new operations near homes and businesses more generally.

On the economic impact of prop 112, I want to highlight that the proposal language “applies to oil and gas development permitted on or after the effective date,“ which should temper the dire warnings about the law’s immediate economic impacts. Colorado Public Radio’s story suggests at least 58% of land in Colorado would be unavailable for fracking:

The Colorado School of Mines recently came to a different number taking into account subsurface access. Professor Peter Maniloff found that 58 percent of the subsurface would be inaccessible in Proposition 112 were to pass. His analysis differs from the state because he tried to consider how companies can drill horizontally for over a mile, going underneath homes and schools to access oil and gas.

While I think the oil and gas industry will have reduced revenues going into the future, the economic case alone is not strong enough to vote against the measure, particularly as Colorado needs to redirect and invest in a more clean and sustainable energy supply.

Lastly, prop 112 is a grassroots campaign measure largely driven by a volunteer base. Spending opposition has outspent the ‘yes’ campaign more than 40 to 1, largely from oil and gas interests and with question practices (“Noble Energy Pumps Unregulated Cash Into Fight Against 112”).

From Vox— Big Oil is using brute financial force to kill 2 state sustainability initiatives

Whatever the merits, it has Big Oil completely freaked out. Protect Colorado, the group leading the opposition, has raised $35.6 million so far, overwhelmingly from the oil and gas industry, companies like PDC Energy, Anadarko Petroleum, SRC Energy, and Noble Energy.

Additional reading:

Whose Colorado? Fracking debate pits families against ‘economic engine’ — CS Monitor

What Proposition 112 — the controversial bid to rein in Colorado oil and gas drilling — would mean for schools — Chalkbeat

How would Proposition 112 impact Colorado’s economy? Two sides with two different stories about well setbacks — Denver Post

Proposition 112: Dissecting the science behind the oil and gas setbacks initiative

Colorado Health Department finds little evidence of health harms from living near oil and gas sites

Ask the Indy: Analyzing seven big questions about Colorado’s ballot fight over oil-and-gas setbacks

Editorial: The case for expanded oil and gas setbacks and Proposition 112 — Daily Camera

Will Toor: Why I am voting for Proposition 112 — Daily Camera

County/City Ballot Measures (Analysis)

County Ballot Issue 1A – (Alternative Sentencing Facility and Jail Modernization Countywide Sales and Use Tax Extension) — YES

WITH NO INCREASE IN ANY COUNTY TAX, SHALL THE COUNTY EXTEND AN EXISTING 0.185% SALES AND USE TAX SET TO EXPIRE DECEMBER 31, 2019, FOR FIVE (5) YEARS TO AND INCLUDING DECEMBER 31, 2024, FOR THE PURPOSE OF FUNDING CONSTRUCTION OF AN ALTERNATIVE SENTENCING FACILITY AT THE BOULDER COUNTY JAIL AND PROVIDING EXPANDED ALTERNATIVE SENTENCING AND OFFENDER MANAGEMENT PROGRAMS TO KEEP LOW-RISK OFFENDERS OUT OF EXPENSIVE JAIL BEDS AND ENABLE BETTER OUTCOMES FOR THE JAIL POPULATION; MODERNIZATION OF THE CURRENT JAIL BUILDING, INCLUDING BUT NOT LIMITED TO, NEEDED INFRASTRUCTURE REPLACEMENT, RENOVATIONS AND REPURPOSING TO PROVIDE A SAFER ENVIRONMENT AND ADDITIONAL SERVICES TO MEET THE MENTAL AND PHYSICAL HEALTH NEEDS OF INMATES; AND SHALL THE PROCEEDS AND THE EARNINGS ON THE INVESTMENT OF THE PROCEEDS OF SUCH TAX CONSTITUTE A VOTER-APPROVED REVENUE CHANGE; ALL IN ACCORDANCE WITH BOARD OF COUNTY COMMISSIONERS’ RESOLUTION NO. 2018-76?

I’m voting yes — funding an alternative sentencing facility would reduce the currently overburdened jail and provide alternatives for those jailed/detained due to the camping ban or suffering from mental illness.

I have not read much discussion on the ballot measure in general online or in newspapers. My main concern is dedicating a large portion of existing sales tax to this purpose that was previously used for flood recovery.

Additional reading:

Boulder County Ballot issue 1A: Alternative Sentencing Facility and Jail Modernization Countywide Sales and Use Tax Extension

City of Boulder Ballot Issue 2C – Imposition of Oil and Gas Pollution Tax — YES

Boulder ordinance language link

SHALL CITY OF BOULDER TAXES BE INCREASED $0 IN 2019 AND BY WHATEVER AMOUNTS ARE GENERATED ANNUALLY THEREAFTER THROUGH THE IMPOSITION OF AN OIL AND GAS POLLUTION TAX AT THE RATE OF UP TO $6.90 PER BARREL OF OIL AND UP TO $0.88 PER THOUSAND CUBIC FEET OF NATURAL GAS FOR OIL OR GAS EXTRACTED WITHIN THE BOULDER CITY LIMITS COMMENCING JANUARY 1, 2019, AND SHALL REVENUE FROM THE TAX BE USED TO FUND COSTS ASSOCIATED WITH OIL AND GAS EXTRACTION IN THE CITY OF BOULDER AND WITH THE REMAINDER USED BY THE GENERAL FUND AND SHALL ALL EARNINGS THEREON (REGARDLESS OF AMOUNT) CONSTITUTE A VOTER APPROVED REVENUE CHANGE, AND AN EXCEPTION TO THE REVENUE AND SPENDING LIMITS OF ARTICLE X, SECTION 20 OF THE COLORADO CONSTITUTION?

I’m voting yes — however, the law would have little to no effect on drilling in Boulder. Per Shay Castle at the Daily Camera, “the tax — up to $6.90 per barrel of oil 88 cents per thousand cubic feet of natural gas — would be paid by drillers, though none have expressed interest in drilling within city limits. The last well in Boulder was capped in the 1990s.” The measure is largely symbolic.

Additional reading:

Boulder advances oil, gas pollution tax with no public comment, little discussion

City of Boulder Ballot Issue 2D – Authorize Retention of All Sugar-Sweetened Beverages Tax — YES

Boulder ordinance language link

WITHOUT RAISING TAXES MAY THE CITY KEEP ALL REVENUES FROM THE 2016 VOTER-APPROVED SUGAR-SWEETENED BEVERAGE PRODUCT DISTRIBUTION EXCISE TAX, AND CONTINUE TO COLLECT THE TAX AT THE PREVIOUSLY APPROVED RATE, AND SPEND ALL REVENUES COLLECTED FOR THE HEALTH EQUITY-RELATED PURPOSES PREVIOUSLY APPROVED BY THE VOTERS, WITHOUT REFUNDING TO DISTRIBUTORS THE AMOUNT THAT EXCEEDED THE REVENUE ESTIMATES APPROVED BY VOTERS IN 2016?

I’m voting yes — I have previously supported the sugary drink tax and still do for the reasons I outlined two years ago. Even if you don’t support the tax, voting against the ballot measure would take taxpayer money collected in our city, earmarked for local non-profits supporting our food system, and return it to distributors of sugary drinks as profit — which would be a terrible outcome for our community. I strongly urge a yes vote.

Additional reading:

Editorial: Not a fan of sugary drink tax? Don’t take it out on Issue 2D. — Daily Camera

City of Boulder Ballot Question 2E – Charter Amendments for Initiative, Referendum and Recall Processes — NO

Boulder ordinance language link

Shall Sections 29, 38A, 38B, 39, 40, 44, 48, 54, 56, and 177 of the City Charter be amended pursuant to Ordinance 8272 to clarify the actions required to be taken if a candidate withdraws from a city council election; establish the number of signatures required for an initiative and referendum to be at least ten percent of the average number of registered electors of the city who voted in the previous two municipal candidate elections so as to return this number closer to the range that was in place prior to changes in federal law and registration procedures; establish the number of signatures required for a recall to be at least twenty percent of the average number of registered electors of the city who voted in the previous two municipal candidate elections; amend the process and establish a fixed schedule for filing, review and consideration of initiative, referendum, and recall petitions so that both petitioners and city staff will have clarity and certainty; set standards for the city clerk’s examination of petitions so that this examination is completed in a timely fashion and that the possibility of fraud is minimized; provide for input from the petition committee to the city council prior to setting the ballot title to help ensure accuracy of the title; and require that an ordinance passed by vote of the people may only be amended by two-thirds of the council members present, and only if the amendments are consistent with the basic intent of the ordinance or are necessary to come into compliance with state or federal law?

I’m voting no — while in general I think the changes are reasonable, the changes to the initiative and referendum process allow a very small percentage of citizens to put a measure on the ballot or to overturn a law passed by city council.

Per Richard Valenty’s write-up on 2E:

If 2E passes, proponents for initiative and referendum measures would need to gather valid signatures from at least 10 percent of an average of total voters during the previous two municipal elections, while the current Charter calls for 10 percent of city registered electors on the day the petition is filed. For example, the 2017 county election report showed 72, 574 active voters in the City of Boulder, so 10% of that would be about 7,257 signatures (current system). City voter turnout was 29,552 in 2015, and 31,765 in 2017, for an average of 30,658, so 10% would be 3,065 signatures (proposed system).

I have two relevant examples here of how the system could be abused: Earlier in 2018, “Funding Our Future abandons plans for Boulder ballot measure to raise taxes on marijuana” in which an organization with no presence in Boulder very quickly gathered signatures to put a measure on the ballot before completely dissolving under more scrutiny.

In 2007, people in central Boulder stopped a housing development by gathering over 9,000 signatures in opposition of a city council approval to allow a housing development at Washington Village on Broadway. If ballot measure 2E passed, a similar opposition could organize by collecting signatures from ~3,000 people, fewer than 3% of city residents.

Enabling small groups of people to control city decisions creates incentives for obstruction and destructive policy. I recommend voting no.

Additional reading:

City of Boulder Ballot Question 2E: Initiative, Referendum, and Recall Process — The Blue Line

Matthew Appelbaum: What to reject on this year’s ballot — Daily Camera

City of Boulder Ballot Question 2F – Charter Amendment for Initiative Petition Signature Verification — YES

Boulder ordinance language link

Shall Sections 39, 46, and 57 of the City Charter be amended pursuant to Ordinance 8273 to require the city clerk, to the extent reasonably possible and so as to ensure authenticity, compare the signatures on a petition to signatures with the election records of the Boulder County Clerk or the Secretary of State?

I’m voting yes — the city would adopt a standard practice used by county and state-level petitions.

Additional reading:

City of Boulder Ballot Question 2F: Initiative Petition Signature Verification — The Blue Line

City of Boulder Ballot Question 2G – Charter Amendment Related to Electronic and Online Petitions — YES

Boulder ordinance language link

I’m voting yes — as the ordinance does not automatically legalize the use of electronic petitions, but does allow the city council to make laws to enable electronic petitions in the future. The city council can (and should) pursue exact implementation details of how the city should enable electronic petitions at a later date.

Additional reading:

City of Boulder Ballot Question 2G: Electronic and Online Petitions — The Blue Line

City of Boulder Ballot Question 2H – Charter Amendment Related to Advisory Commissions — NO

Boulder ordinance language link

Shall Section 130 of the Charter be amended pursuant to Ordinance 8271 to: allow council to set the number of any new advisory commission as five or seven when forming the commission; allow council to increase the size of the Housing Advisory Board from five to seven members; change the criteria for what constitutes a majority to accommodate boards of different sizes; and change the reference of “sex” to “gender identity?”

I’m voting no — even though the measure contains some needed changes. I completely support the change from ‘sex’ to ‘gender identity’ — but the language for other changes is needlessly constrictive and undemocratic in how/when board members are selected.

The Housing Advisory Board should be larger and more representative of the population our city, which the ballot language does not address. Per Shay Castle at The Daily Camera:

The initial board had only one renter — Masyn Moyer — and four homeowners, despite the fact that Boulder itself is 52 percent renters. Three of the five members were also associated with slow- or no-growth political groups: May and Adam Swetlik are members of PLAN Boulder County, and Judy Nogg served on the leadership group of Together4Boulder.

I agree completely with former Boulder Mayor Matt Appelbaum:

“Question 2H correctly allows council to create seven-member boards, but contains serious flaws. It reasonably ups the housing board to seven, but absurdly leaves the far more important, and deserving of additional viewpoints, transportation and open space boards at five. As written, 2H apparently requires that the two years in which two of seven board members are replaced will be consecutive, allowing a single council to appoint a majority. Make council try again.”

Additional reading:

City of Boulder Ballot Question 2H: Advisory Commissions — The Blue Line

New housing board pick checks the boxes for Boulder leaders — Daily Camera

Matthew Appelbaum: What to reject on this year’s ballot — Daily Camera

City of Boulder Ballot Question 2I – Charter Amendment for Planning Department Budget Recommendations — YES

Boulder ordinance language link

Shall Section 78 of the Charter be amended pursuant to Ordinance 8270 to change the time for the Planning Department to submit its recommendations for public improvements from sixty days to thirty days before the submission of the budget to be consistent with the city’s budgeting process?

I’m voting yes — the measure would allow the planning department to finish its reporting later in the budget cycle, and according the Mayor Zan Jones, would allow “the Planning Board… to review proposed capital improvement projects as part of their budget review process (rather than after the fact), thereby better aligning and improving the City’s overall budget process.”

Additional reading:

City of Boulder Ballot Question 2I: Planning Department Budget Recommendation — The Blue Line

Urban Drainage and Flood Control District Ballot Issue 7G — YES

Ballotpedia link

SHALL URBAN DRAINAGE AND FLOOD CONTROL DISTRICT TAXES BE INCREASED $14.9 MILLION IN 2019 (RESULTING IN AN ANNUAL TAX INCREASE NOT TO EXCEED $1.97 IN 2019 FOR EACH $100,000 OF ACTUAL RESIDENTIAL VALUATION) AND BY SUCH AMOUNT AS MAY BE RAISED ANNUALLY THEREAFTER FROM A LEVY NOT TO EXCEED 1.0 MILLS TO PAY FOR DISTRICT WORK IN COORDINATION WITH LOCAL GOVERNMENTS, INCLUDING:

1. MAINTAINING EARLY FLOOD WARNING GAUGES TO PROVIDE POTENTIAL EVACUATION WARNINGS,

2. PROVIDING TRAILS, WILDLIFE HABITAT, AND RECREATIONAL ACCESS TO RESIDENTS BY PRESERVING THOUSANDS OF ACRES OF PARKS AND OPEN SPACE IN FLOODPLAIN AREAS WHICH PROTECT THE ENVIRONMENT AND PRIVATE PROPERTY, AND

3. REMOVING DEBRIS, GARBAGE AND OBSTRUCTIONS FROM STREAMS, CREEKS AND RIVERS RESULTING IN REDUCED RISK TO THE HEALTH AND SAFETY OF RESIDENTS, PROTECTING PROPERTY, AND RESTORING NATURAL BEAUTY;

WITH THE DISTRICT’S ENTIRE MILL LEVY RATE SUBJECT TO STATUTORY CAPS AND TO ADJUSTMENT TO OFFSET REFUNDS, ABATEMENTS AND CHANGES TO THE PERCENTAGE OF ACTUAL VALUATION USED TO DETERMINE ASSESSED VALUATION; AND SHALL ALL DISTRICT REVENUES BE COLLECTED, RETAINED AND SPENT NOTWITHSTANDING ANY LIMITS PROVIDED BY LAW?

I’m voting yes — flood control and funding will continue to be important in climate change resiliency. I found the write-up from Mayor Zan Jones convincing on the topic:

The District’s property tax rate hasn’t been raised in 50 years, but the 1992 Taxpayer Bill of Rights (aka TABOR) resulted in the ratcheting-down of the flood-control district’s dedicated property tax rate from $1 per $1,000 of assessed value to 56 cents today. Under 7G, the District is asking for permission to restore its full taxing authority, as many other cities and counties have done. The impact on the average home would be about $13 annually. Each city and county receives back the same amount of funding as they contribute, and benefits from well-designed flood control infrastructure.

Additional reading:

Urban Drainage and Flood Control District Ballot Issue 7G — Daily Camera